Q&A with Management

How does the company go about sourcing information from each such supplier about the origin of conflict minerals in your products?

Answered in the September 30, 2024 Investor Presentation. Please refer to Air T’s Form SD filed with the SEC, available in this link:

https://www.sec.gov/Archives/edgar/data/353184/000035318424000055/a2024formsd-airt53124.htm

What is your interest coverage ratio and what’s the risk you won’t be able to service your debt this year and next?

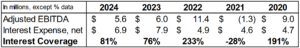

Answered in the June 30, 2024 Investor Presentation. Thank you for this question. We received a similar one last quarter. The table below shows historical information that may help you understand Air T’s interest coverage ratio better. Company policy dictates that we do not make forward looking statements.

Additionally, our corporate policy is to endeavor to reinvest our cash flows in positive expected return investments whenever possible. Management believes that, at the margin, it can reduce cash expenditures by reducing optional

cash capital expenditures and cash-consuming initiatives. We, at any time, believe we have the option to reduce our investment level, in addition, we can cut corporate expenses that are related to growth. Note that our bank

covenants are calculated before considering funding for certain business units that Air T funds at its discretion.

Most conglomerates have a business they rely on as their steady cash cow (think GEICO for Berkshire, etc.) what business of yours is the backbone of AIRT?

Answered in March 31, 2024 Investor Presentation. Fortunately, we believe that we have a number of businesses that fall in this category. We would highlight that Mountain Air Cargo has been a consistent cash producer for us in the past with the exception of FY2020. The relatively low performance during that year was due to leadership changes that we have since remedied. After this change, MAC’s performance has stabilized. Global Ground Support is also a steady cash generator with the exception of FY2024 where, due to costs associated with management changes and reduced orders from customers in part due to the cyclicality and the unseasonable light winter, GGS had their first down year in recent history. Historical performance shows that GGS produces a consistent $2-$3 million in EBITDA but has reached levels of greater than $9 million in recent years.

The commercial jet engines and parts division has seen massive growth recently. I believe you have partners in this business. What is the comp structure?

Answered in March 31, 2024 Investor Presentation. As indicated on slide 17 of our Investor Presentation, you can see that our Aircraft JVs have been growing. They receive standard aviation industry management fees that include an incentive fee of approximately 20% above a hurdle rate of 0% to 8%, depending on the JV. Our Aircraft JV investors seek to generate 10%+ returns.

Does anyone even review this process?

Answered in March 31, 2024 Investor Presentation. Our interactive Q&A capability, through Slido.com, allows shareholders to ask questions of our management. We plan to present and answer all questions received in a given quarter through a section in the quarterly Investor Presentation. We plan to release an Investor Presentation each quarter with the filing of our financial statements.

What is the status of the AIRTP May dividend payment?

Answered in March 31, 2024 Investor Presentation. The AIRTP dividend payment scheduled for May was paid as scheduled on May 13, 2024

As EBIT has been volatile, it’s been difficult to discern what to expect regarding interest coverage. What do you expect your typical interest coverage ratio to be?

Answered in March 31, 2024 Investor Presentation. Company policy dictates that we do not make forward looking statements. However, you can see in the table below historical information that may help you understand Air T and our interest coverage better.

![]()

Our corporate policy is to endeavor to reinvest our cash flows in positive expected return investments whenever possible. Management believes that, at the margin, it can reduce cash expenditures by reducing optional cash capital expenditures and cash-consuming initiatives. We, at any time, believe we have the option to reduce our investment level, in addition, we can cut corporate expenses that are related to growth. Note that our bank covenants are calculated before considering funding for certain business units that Air T funds at its discretion.

Why is your stock down?

Answered in December 31, 2023 Investor Presentation. We do not comment on our stock price.

Why do you think issuing Trust Preferreds ("TruPs") addresses your liquidity issues?

Answered in December 31, 2023 Investor Presentation. TruPs are long-term capital with a periodic fixed obligation. This type of capital is well matched with the long-term businesses and assets that Air T owns. Because they are traded on the open market, we can buy and sell TruPs to manage our liquidity needs.

Why is this private company rife with conflicts of interest allowed to be publicly traded?

Answered in December 31, 2023 Investor Presentation. We follow the law. We care about our brand. Our board, auditors and SEC lawyers take very seriously all legal and regulatory conflicts of interest rules and concerns. Our CEO’s annual salary has never been more than $50,000. All of our AIRT employee equity incentive vesting requirements are tied to the performance of the stock; and, to date, none of the stock return vesting tests have been met.

Why doesn’t this company just part itself out? Surely the two owners of 66% realize that a sale and debt paydown is better than an equity wipeout.

Answered in December 31, 2023 Investor Presentation. Thank you for your assertive question. We believe in the power of building businesses for the long term, and holding them in a public company structure allows us to do that. We believe in the Allocator/Operator Partnership – redeploying cash flows from businesses into high potentialities. We believe that over time our businesses are likely to generate cash flows for investment or principal repayment. We consider the combined value of these businesses to be greater than the individual parts. In addition, if we listen carefully and do our job correctly, Air T’s independent yet interrelated business enterprises may have emergent properties that isolated individuals do not possess.

How is Air T, Inc preparing itself for a future with EVTOLs?

Answered in December 31, 2023 Investor Presentation. We work closely with our partners in the aviation industry to be on the cutting edge of pragmatic innovation. Therefore, we feel like we will be able to implement new flight technologies as they are adopted by the market. We do not have any EVTOL projects underway at this time.

Can I receive proxy statements online instead of via hard copy sent via snail mail?

Do you pay ordinary dividends or make partner distributions?

Never say never, however, we have made one special dividend to shareholders in the past. The distribution consisted of Trust Preferred securities and warrants to purchase additional trust preferred securities. The total face value of the Trust Preferred securities distributed was $4 million or approximately $1.30 per share.

Investors who are interested in owning an income generating security should consider owning our Trust Preferred securities which have a $2.00 annual dividend per share.

With the increased cash, any plans to reduce debt as in buying back some of the high rate AIRTP trust securities?

Can you please update us on the status of the aviation ground support equipment segment and its outlook. Does the recent slump in sales suggest future demand?

The Trust Preferred Securities cost Air T 8% annually. Are you confident you will be able to earn in excess of an 8% return when investing this capital?

Answered on August 17, 2021. We believe the past year has proven that the future is much like a foreign country: sometimes strange and always impossible to forecast. Yet we believe on balance that the cash flow dynamics of our Trust Preferred (30 year bullet maturity) are similar to low-cost, 10-year amortizing bank facilities. Moreover, note that the interest on AIRTP 8% is tax deductible to Air T, Inc. so our after-tax hurdle is lower than 8%.

Adjusted EBITDA at GGS went from $9.13 MM in FY21 to $3.45 MM in FY22 due, in part, to fewer truck sales to the US Air Force. Any possibility of diversifying sales to other customers in the ground support equipment sector?

It would be helpful if you could disclose some of the major customers within the Ground Equipment Sales segment besides the USAF?

Most major domestic airlines

Several domestic regional airlines

Most major cargo operators

Foreign Militaries such as the Royal Canadian Airforce

Various Foreign Customers

How do you plan to allocate capital going forward?

Answered on August 17, 2021. We believe, theoretically, that the Kelly Criterion is the best framework we know by which to judge an investment’s merit. Simply speaking, how much edge (or insight) do we have into the future state of an outcome, as compared to the payoff odds of that outcome?

In some sense, AIRT is set up as an idea factory that generates “looks” at various investments. Possibilities occur when real companies generate real investment projects, when our research and trading platform generates theses about compelling securities, and when our network generates private or special situations. We ‘get the call’ in each of these cases.

The more unique and insightful ‘looks,’ the greater possibility we will have a favorable edge given the payoff odds.

We don’t foresee a major change in our capital deployment strategy in the next 12 months.

Can you outline what you believe returns will likely be on the capital you've invested into Air T's various businesses?

Answered on August 17, 2021. We cannot predict or guarantee the returns we will earn going forward, but below are our aspirational goals for each segment:

Air Cargo: 20%+ unlevered

Ground Support Equipment: 20%+ unlevered

Commercial Jet Engines and Parts: 10%+ unlevered

Public and Private Securities: 15%+ unlevered

Could you outline what the future looks like over the next 3 - 5 years for Air T overall and also specifically for each of the businesses you own?

Answered on August 17, 2021. We strive to direct AIRT’s capital to businesses and projects that generate attractive returns. We firmly believe a 20% hurdle rate is a healthy challenge given our size and opportunity set. Of course, we will at times fail to reach our goals. We think very hard about generating sustainable value that sets us up for future growth. To do that, we set out to identify and develop strong investor-operator partnerships with the people and teams who are running our businesses. We want to secure and empower these management teams. We believe that if we do this well, we will build lasting value for our shareholders and we will build an investor base whose goals and philosophies are consistent with our own. These are simple, but powerful ideas that we will strive to execute well.

Perhaps you are thinking: “Seems like this is what every private equity firm and investor is trying to do, what’s your edge?” Imagine that our Holdco Investing team is focused on empowering skilled management teams, and those managers focus on building their businesses without regard to an expiration date (like a P.E. firm) and with appropriate autonomy not found in most public companies (love you Jack Welch). Now imagine that occasionally, and unpredictably, these businesses generate real options that we identify and capitalize intelligently. Then this might, in some scenarios, represent a sustainable edge for Air T’s business model.

At your deicing business, do you see this as just a stable business or does this business have the ability to grow over time?

Answered on August 17, 2021. While the business can be highly cyclical, the Global Ground Support team has proven their ability to grow this business over the last several years and we expect them to continue searching for new ways to grow; they are not standing still.

Could you outline what you think the future looks like for the deicing segment?

Answered on August 17, 2021. We are focused on continuing to take market share and leading innovation in aircraft deicing. We will always be on the lookout for adjacent market or acquisition opportunities. The leadership at Global Ground Support is very strong, and we would welcome the opportunity to deploy additional capital under this team if the right opportunity presents itself.

Could you also disclose the customers and counterparties at the Commercial jet engines and parts segment?

Answered on August 17, 2021. Typically, aftermarket parts are sold to a range of airlines, cargo operators, and MRO shops worldwide. Customers and Counterparties that have been disclosed in our SEC filings include: Air Macau, DAE, Interjet, and Sun Country Airlines. Our Commercial Jet Engines and Parts segment does not have major customer or counter-party concentration at this time.

It would be helpful if you could describe how you view the competitive advantages of Air T's various businesses?

Answered on August 17, 2021.

Air Cargo: 40-year relationship as a trusted provider for FedEx.

Ground Support Equipment: Largest provider of deicing equipment in the country. Longstanding relationships with all major deicing customers worldwide and a strong management team.

Commercial Jet Engines: Longstanding industry relationships and a strong management team combined with a specialization on end -of -life aircraft management we feel provides a strong foundation to earn above -average returns in the industry.

What are your key initiatives over the next year?

Answered on August 17, 2021. We are in a pandemic that has put tremendous strain on aviation, the sector in which many of our businesses operate. These challenges will continue to be a major area of focus over the next year. One of the growth initiatives we have mentioned in our past investor presentations is creating unique investment products with outside capital partners. We have products in advanced stages of development which will continue to be a major area of focus for us over the next year. Of course, intelligently investing the capital recently raised in Contrail JV II, LLC is one of our highest priorities.

The Commercial Jet Engine segment really took off after you acquired Contrail. Why did it do so well? What drove this performance pre-COVID?

Answered on August 17, 2021. After acquon by Air T, Contrail expanded its aircraft trading and leasing operation with the opening of the Denver, Colorado office. This, combined with a strong banking relationship with Old National Bank, allowed the team to significantly expand trading operations that leveraged core competencies.

Could you outline the vision with the Commercial Jet Engines and Parts segment? What could this business look like in 3, 5, and 10 years?

Answered on August 17, 2021. If we execute well, then it’s possible to imagine that this segment will become a much larger player in the industry over the next 5 – 10 years. We believe the total addressable market is large, and they have an ambitious leadership team.

We believe the COVID-19 pandemic and subsequent turmoil in the aviation industry will present a major opportunity for Contrail to play offense over the next 5-10 years. We believe the combination of Contrail, Worthington, AirCo, and Jet Yard provide a strong end-of-life aircraft management platform that can be used to maximize the value of these assets. We believe we can use this platform to manage our own assets as well as assets on behalf of outside capital partners.

At the Commercial Jet Engines and Parts segment, do the various subsidiaries work together or are they pretty independent of one another?

Answered on August 17, 2021. Contrail has separate management and historically has not worked closely with the other Commercial Jet Engines and Parts companies. This may change over time as various opportunities present themselves that would benefit both Contrail and the other Air T entities. Worthington/AirCo/Jet Yard are more closely integrated with Mark Harris as the CEO.

At your Commercial Jet Engines and Parts segment does Jet Yard tear apart planes and the other companies sell those parts?

Answered on August 17, 2021. There is some cooperation of that nature between Jet Yard and AirCo. However, most of Jet Yard’s teardown business has been for outside customers.

Can you help us better understand what drove the loss at the Commercial Aircraft Engines and Parts segment?

Answered on August 17, 2021. The loss is driven by Covid-19, causing overall lower activity levels in commercial aviation. Fewer planes are being bought, sold, and leased, fewer engines are being bought, sold and leased, fewer replacement parts are being bought, all in line with overall declines in aviation activity that have failed to produce volumes at or above our fixed cost.

How do you think about the returns you will earn on the capital invested in the Commercial Jet Engines and Parts segment?

Answered on August 17, 2021. Our aspirational goal is to earn a minimum 10% unlevered Return on Invested Capital (ROIC).

The Commercial Jet Engines & Parts segment has been allocated the most capital, therefore, can you provide more information on the segment & outline the vision?

Answered on August 17, 2021. The goal of the commercial aircraft segment is to be a premier provider of third-party aircraft/airframes/engines/parts. We seek to maximize the value of aircraft in the later stage of their lifecycle (15+ years old).

How integrated are the subsidiaries in the Commercial Jet Engines and Parts segment?

Answered on August 17, 2021. Contrail has separate management and historically has not worked closely with the other Commercial Jet Engines and Parts companies. This may change over time as various opportunities present themselves that would benefit both Contrail and the other Air T entities. Worthington/AirCo/Jet Yard are more closely integrated with Mark Harris as CEO.

Any help in terms of understanding the loss at the Commercial Aircraft Engines and Parts segment on a more granular level would be helpful?

Answered on August 17, 2021.

Contrail: Buys, Sells, and Leases entire aircraft and aircraft engines. Also tears downs engines to be sold for parts. Primarily focused on 737 and A319/A320 aircraft. Primary operations in Madison Wisconsin and Denver Colorado.

Worthington: After-market parts and repairs for regional aircraft (under 150 seats). Primary operations in Eagan Minnesota.

AirCo: commercial airframe liquidator primarily focused on 737 and A320 aircraft. Primary operations in Eagan Minnesota.

Jet Yard: End-of-Life aircraft services company based at Pinal Airpark in Marana Arizona. Primarily focused on aircraft teardowns, part outs, and storage.

Was the loss at the Commercial Aircraft Engines and Parts segment caused by asset impairments, customers defaulting on leases, or something else?

Answered on August 17, 2021. The loss is driven by overall lower activity levels in commercial aviation. Fewer planes are being bought, sold, and leased, few engines are being bought, sold and leased, fewer replacement parts are being bought, all in line with overall declines in aviation activity. We have taken a write-down in inventory to account for current market conditions. The cash and non-cash P&L impacts can be discerned from our 10K.

What is the rationale for the investment in Cadillac Castings?

Answered on August 17, 2021. Cadillac Casting is a Ductile Iron Foundry located in Cadillac, Michigan with a capacity to produce approximately 1.4 million molds per year. An elderly shareholder of Cadillac Casting wanted to sell in 2019 and Air T was among several parties who purchase the shares as part of the elderly-shareholder’s exit. An independent committee within Air T conducted due diligence and approved the purchase of this stake. This investment is completely independent from Air T’s other operations and investments.

Latest

Air T to Present at the Planet MicroCap Showcase: VEGAS in partnership with MicroCapClub on Wednesday, April 23, 2025 & 1×1 Meetings on Thursday, April 24, 2025

Air T to Present at the Planet MicroCap Showcase: VEGAS in partnership with MicroCapClub on Wednesday, April 23, 2025 & 1×1 Meetings on Thursday, April 24, 2025

Air T, Inc. Reports Third Quarter Fiscal 2025 Results

Air T, Inc. Reports Third Quarter Fiscal 2025 Results

Contact

When does the Company’s fiscal year end?

Our fiscal year ends on the last day of March.

When is your annual shareholders meeting?

Air T’s annual shareholders’ meeting is usually held in August. We provide the specific date, time and place for each year’s shareholder meeting in our annual proxy statement and through this website.

Who is your transfer agent?

Equinity

Operations Center

6201 15th Avenue

Brooklyn, NY 11219

Telephone: (800) 468-9716

Contact: Contact Equinty Here

Account access via Web site: www.equinity.com

Ticker Symbol: AIRT